10F, Building B, Erqi Center, Erqi District,

Zhengzhou City,

Henan Province, China

Wit:+86 15138685087

(WhatsApp/Wechat)

10F, Building B, Erqi Center, Erqi District,

Zhengzhou City,

Henan Province, China

Wit:+86 15138685087

(WhatsApp/Wechat)

Since November 19, Yemen’s Houthi armed forces have frequently attacked commercial vessels associated with Israel in the Red Sea and nearby waters, triggering market concerns about the security of the Suez CCanal – Red Sea route. Shipping companies in the past have ordered their ships to avoid the route and instead sail around the Cape of Good Hope on the southwestern tip of Africa.

In the short term, the Red Sea crisis will lead to increased shipping costs for container ships, increased shipping days, and delayed delivery times; The steel transportation is mainly dry bulk cargo ships, which are less affected.

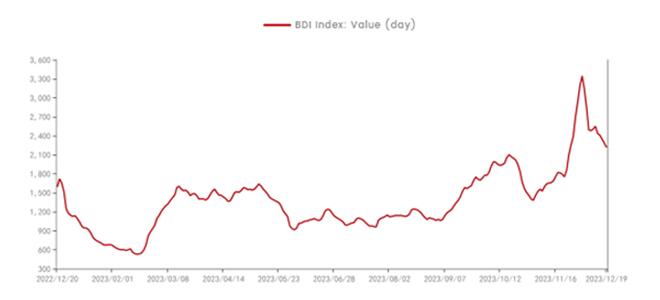

As early as November and early December, the Baltic Dry Index (BDI) has shown signs of continuous gains. According to industry sources, this increase is mainly due to the EU’s carbon tax on shipping companies starting in January 2024, when the shipping surcharge will increase by about $4/ton. To save distribution costs, shippers tend to concentrate shipments at the end of the year. In addition, the short-term concentrated shipment demand of the three major iron mines is also large. Meanwhile, its alternative route, the Panama Canal, is in bad shape. The average waiting time for ships to pass has increased from 4.3 days at the beginning of November to 11.7 days in December, leading to greater pressure on the global shipping industry. In mid-December, due to the decline in the Capesize freight index, the Baltic Dry Index continued to fall, but it remained high compared with the same period last year, bringing some pressure to steel exports. On December 15, the Baltic Dry index was 2219, down 3.02% on the month and up 43.35% on the year.

BDI Index

According to the feedback of an exporter in East China, the Red Sea crisis has little impact on overseas exports; On the ocean side, China’s offer to Turkey and other European markets has not changed much, and the market has a strong wait-and-see atmosphere. Another East China exporter feedback, sent to the main port of Europe steel freight rose 10-15 USD/ton, but according to the feedback of the shipping industry, this round of increase is mainly driven by the above-mentioned factors, and the Red Sea crisis has little to do with.